1099 Processing in Oracle Account Payables

Oracle every year releasing patches which contains updates to Oracle Payable to reflect 1099 tax reporting changes required by the United States Internal Revenue Service (IRS) for that tax year.

After patching, AP managers extract last year data by running set of stanard programs and provide those data to IRS. IRS accepts only those data which as per standard defined.

Here I will provide steps/setups required regarding 1099 processing in Oracle Account Payables-

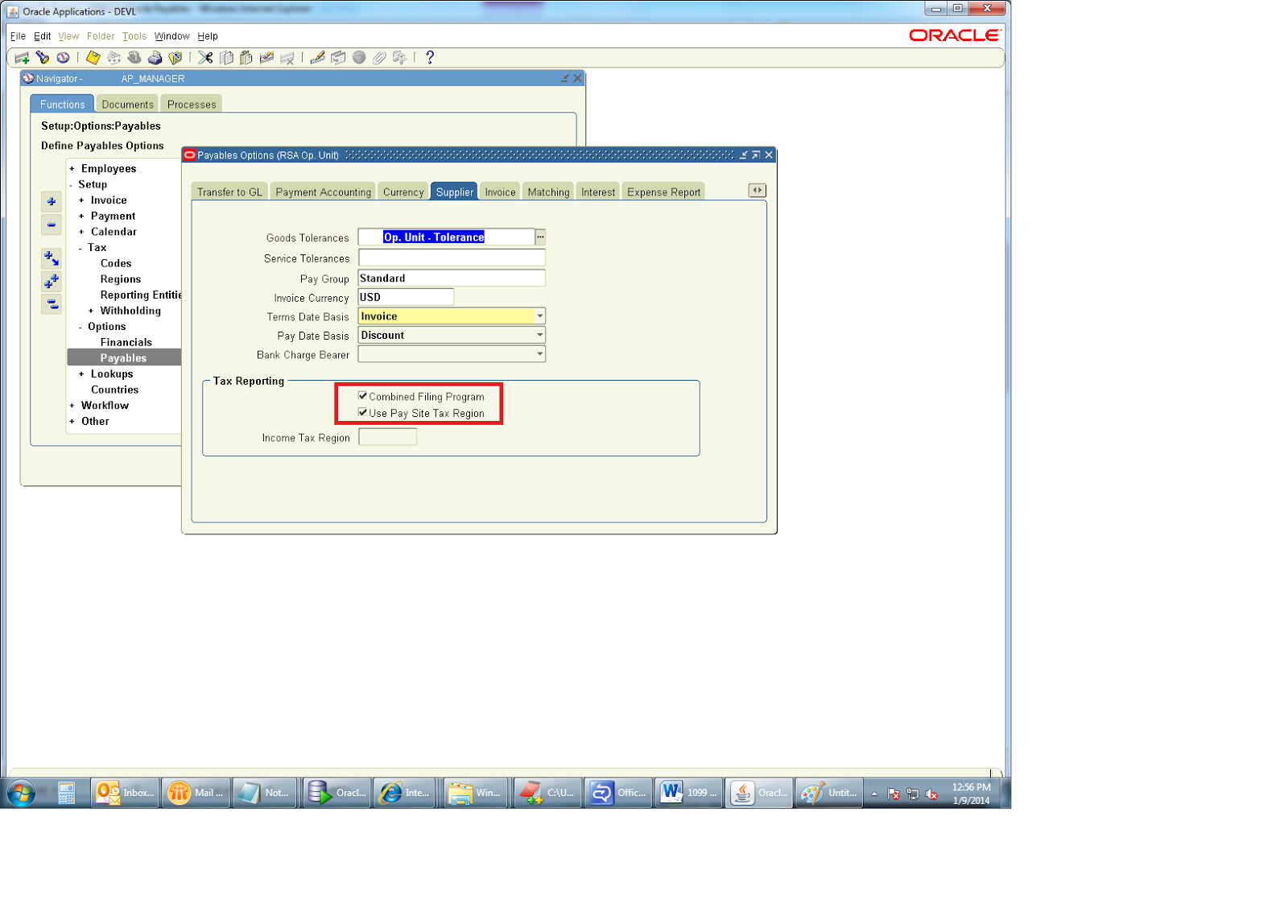

- Enable combined filling in Payables options under Supplier tab

Navigation: Setup > Options > Payables

- Setup tax reporting entities

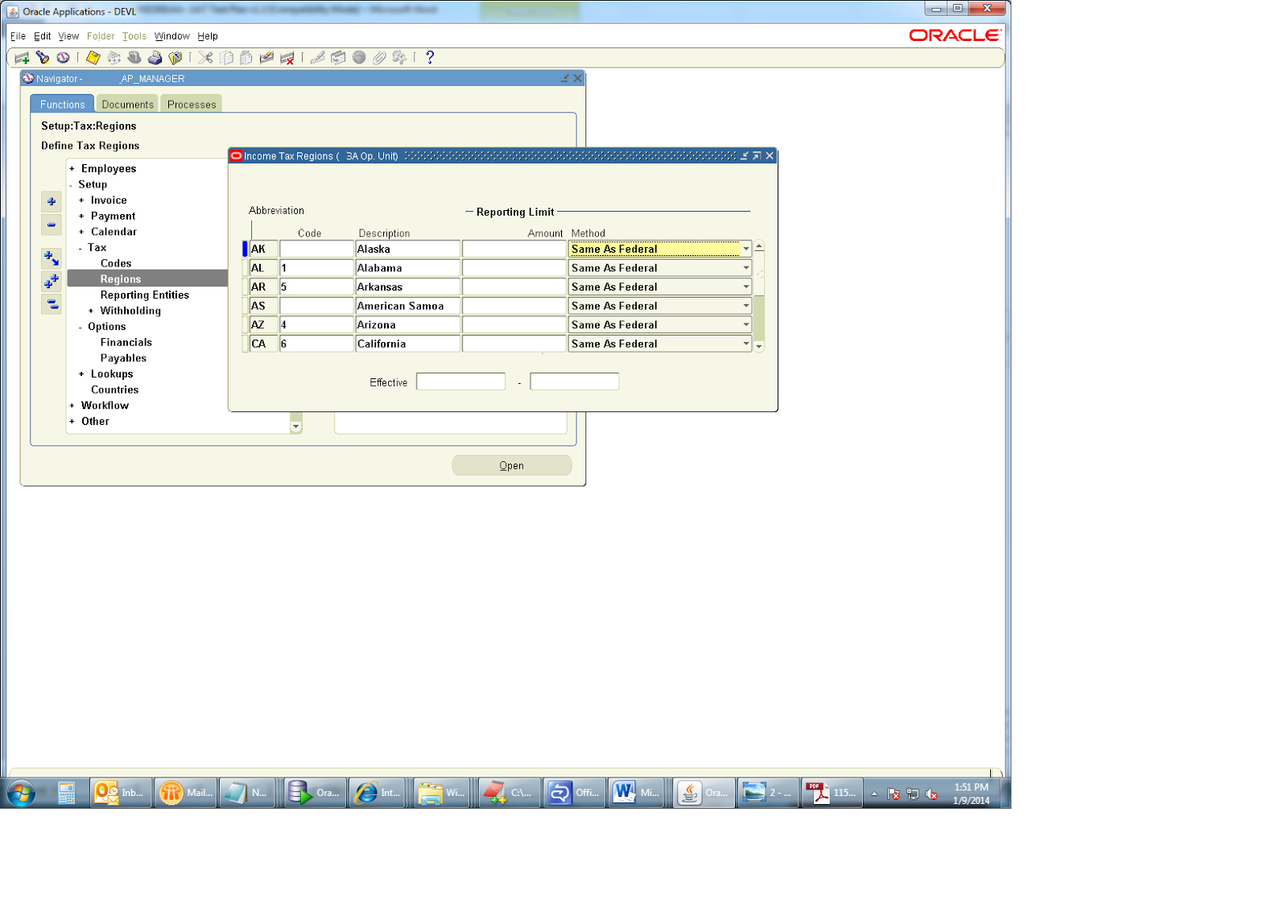

- Setup tax regions

Use the Income Tax Regions window to define your tax regions if you are using 1099 Electronic Media Combined Filing Program reporting in the United States. If you enable the Combined Filing Payables option,

when you submit the 1099 Electronic Media Payables produces K records for all tax regions (or states) participating in the Combined Filing Program that have qualifying payments. Payables also produces

B records for suppliers with 1099 payment amounts that equal or exceed the tax region’s reporting limit in qualifying states.

Payables has predefined the region abbreviations and the descriptions for all U.S. States, the District of Columbia, and some U.S. Territories. Payables has also predefined the region codes for those tax regions that

are participating in the Internal Revenue Service’s current Combined Filing Program. You must enter a region code for all tax regions that you wish to use for the Combined Filing Program reporting and that Payables has not already defined. You cannot update the predefined region abbreviations, descriptions, or region codes.

- Setup supplier as reportable

Reportable, Federal : Must be checked

Income Tax Type: This MISC code will default into the invoice distributions

Reportable, State: This controls if State Code on the Site is required and if there is an LOV for the State Code

Reporting Site: This will be filled in for you from the SITE

Reporting Name: If you want the Suppliers Name to be different on the 1099s

Organization Type: Used for the 1099 Electronic Media, and must be one of below-

• Corporation

• Government Agency

• Individual

• Partnership

• Foreign Corporation

• Foreign Government Agency

• Foreign Individual

• Foreign Partnership

If you participate in the United States IRS Combined Filing Program and you make payments to a foreign supplier, you need to ensure that you select one of the foreign Organization Types to indicate that the supplier is a foreign entity. If you made 1099 payments to a foreign supplier, Payables flags the B records in your 1099 tape for those suppliers who meet the Internal Revenue Service’s reporting limit.

Oracle supports the following boxes on the 1099 MISC form:

MISC1 (Rent)

MISC2 (Royalties)

MISC3 (Prizes and awards)

MISC4 (Federal income tax withheld)

MISC5 (Fishing boat proceeds)

MISC6 (Medical and health care payments)

MISC7 (Non-employee compensation)

MISC8 (Substitute payments in lieu of dividends or interest)

MISC10 (Crop Insurance Proceeds)

MISC13 (Gross Proceeds Paid to an attorney)

MISC14 (Excess Golden Parachute Payments)

MISC15A (Section 409A Deferrals)

MISC15B (Section 409A Income)

- Setup Supplier site as tax reporting site

- Create invoice against this supplier.

In distribution level enter income tax type if its not defaulted from suppliers records and income tax region if its defaulted from suppliers site.

Also check invoice amount is exceeding federal/state limit to appear on extract or report.Some important Oracle Standard used to extract 1099 tax data which will be sent to IRS-

1099 Electronic Media

Submit the 1099 Electronic Media report to generate your summarized 1099 information in electronic format as required by the Internal Revenue Service. You can create this file in a format to either send electronically or store on a diskette or magnetic tape to send to the Internal Revenue Service.

Oracle has provided set of 1099 programs which you can use it for excemption or debug purposes.

1099 Supplier Exceptions Report

Use the 1099 Supplier Exceptions Report to review suppliers with inaccurate or incomplete 1099 income tax information. You can run the 1099 Supplier Exceptions Report before you submit your 1099 reports

to identify suppliers that Payables will treat as exceptions in your 1099 reports. You can correct these supplier exceptions in the Suppliers window.

1099 Invoice Exceptions Report

Use the 1099 Invoice Exceptions Report to review paid invoice distributions with inaccurate or missing 1099 income tax information. Before you run your 1099 reports, you should run the 1099 Invoice

Exceptions Report for each tax entity to identify any invoice distributions that Payables will treat as exceptions in your 1099 reports.

Update Income Tax Details Utility report

You can choose to run this utility in one of two modes. If you submit the utility in report mode, for each section, the report lists the number of distributions that will be updated when you submit the utility in update mode. If you run the utility in update mode, the report lists the number of distributions updated by the utility.

1099 Payements Report

Use this report to review payments made to your 1099 reportable suppliers. You can use this report to reconcile to your 1099 Forms, or to prepare additional reporting. For example, you can use this report to get information needed to file 1099 reporting with states that do not participate in the combined filing program.

Refer Oracle Support site and Oracle Payables user guide for more information.

Nice document

ReplyDeleteThank you for your share. Very supportive and helpful

ReplyDelete